Highlights Include:

- 68.55 composite metres of 0.82% NiEq (56.2 GT) starting at 129 m vertical depth

- 57.40 composite metres of 0.82% NiEq (51.5 GT) starting at 162 m vertical depth

- 49.40 composite metres of 0.61% NiEq (30.1 GT) starting at 219 m vertical depth

- 43.20 composite metres of 0.62% NiEq (27.6 GT) starting at 303 m vertical depth

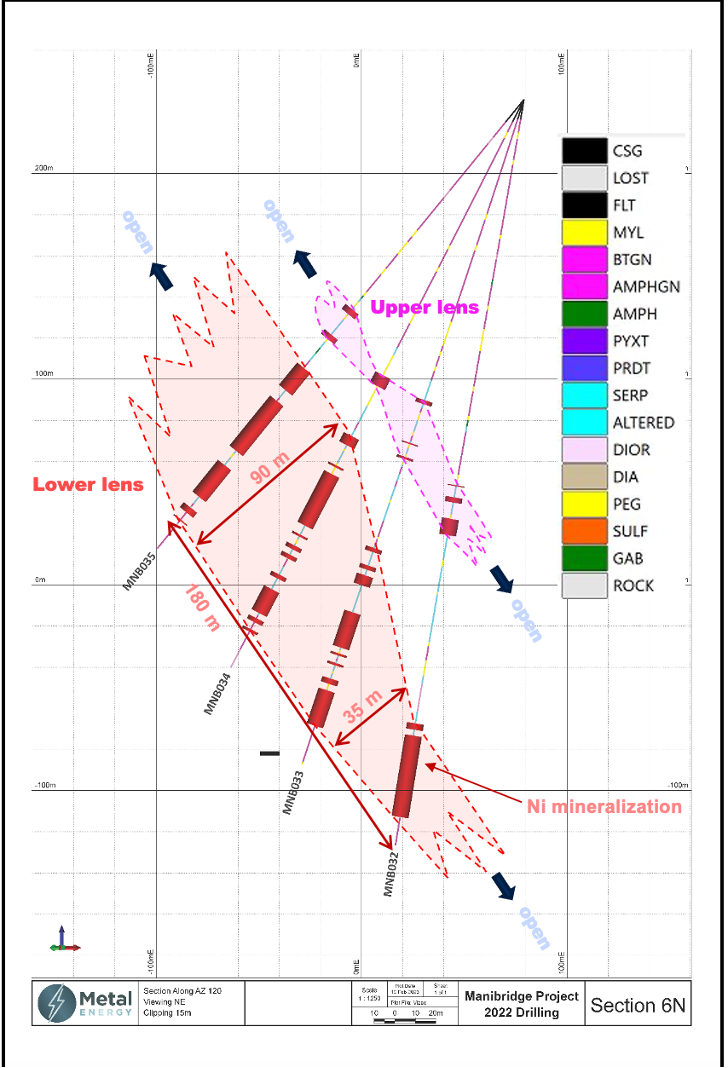

- Mineralized zone is up to 90 m thick, and open in both dip directions (see Figure 1)

- Assay results from 5 drill holes pending

Toronto, Ontario – February 13, 2023 - Metal Energy Corp. (the "Company" or "Metal Energy") (TSXV: MERG, OTCQB: MEEEF) is pleased to announce assay results from four drill holes on the same section (Table 1, Figure 1) of the Phase Two drill program on the high-grade nickel and copper-cobalt Manibridge project (the "Project" or "Manibridge") in the Thompson Nickel Belt, Manitoba. Phase Two's 10,000 m drill program was completed in December 2022, with five additional drill hole assay results still pending.

Table 1 - Drill hole composite assay results from Section 6N

|

DDH |

Composite Width (m) |

Ni% |

Cu% |

Co% |

NiEq% |

GT (NiEq% x m) |

| MNB032 | ||||||

|

Upper Lens |

11.20 |

0.39 |

0.01 |

0.01 |

0.41 |

4.6 |

|

Lower Lens |

43.20 |

0.62 |

0.01 |

0.01 |

0.64 |

27.6 |

| MNB033 | ||||||

|

Upper Lens |

3.65 |

0.36 |

0.01 |

0.03 |

0.41 |

1.5 |

|

Lower Lens |

49.40 |

0.59 |

0.01 |

0.01 |

0.61 |

30.1 |

| MNB034 | ||||||

|

Upper Lens |

5.95 |

0.43 |

0.01 |

0.01 |

0.46 |

2.7 |

|

Lower Lens |

57.40 |

0.79 |

0.02 |

0.01 |

0.82 |

47.1 |

| MNB035 | ||||||

|

Upper Lens |

5.72 |

0.55 |

0.01 |

0.01 |

0.57 |

3.3 |

|

Lower Lens |

68.55 |

0.79 |

0.02 |

0.02 |

0.82 |

56.2 |

|

Notes: |

||||||

Figure 1 – Cross-section of results for Section 6N (MNB032 to MNB035)

"Drill holes MNB035 and MNB034 contained impressive individual high-grade intersections of 1.19% NiEq over 31.3 m (37.3 GT) and 1.10% NiEq over 28.15 m (31.0 GT), respectively. These four drill holes expand a shallow high-grade nickel zone that was never discovered previously at Manibridge. This particular mineralized zone is 100 m along strike, 40 to 90 m thick, extends for at least 180 m in the dip direction, and is open in both dip directions. The Phase 2 drill program continues to redefine the system at Manibridge with over 1 kilometre of strike, and mineralization down to at least 800 m depth. The broader mineralized envelope is large with multiple high-grade zones being discovered recently. Drilling continues to intersect wide, hide-grade nickel intercepts with similar grade-thickness values ("GT") consistent with what was previously mined at Manibridge. We are planning our Phase 3 drill program to continue the success at Manibridge," said James Sykes, CEO of Metal Energy.

Manibridge Phase 2 Drill Program Results

A total of 10,091 metres were completed over 36 diamond drill holes, including 6 abandoned drill holes, with all completed drill holes intersecting visible nickel sulphides. The drill hole collar locations were all within 150 to 600 metres of the old mine workings. The drill holes targeted the shallower parts of the Manibridge nickel sulphide system at depths between 100 and 400 metres from surface.

Assay results for drill holes MNB036 to MNB040A are still pending and will be reported after the data has been received, reviewed, and approved.

Metal Energy is the operator and owns 85% of the Project with Mistango River Resources Inc. (CSE: MIS), an Ore Group company, owning the remaining 15%.

Table 3 provides the individual and composite assay results and Table 4 provides the collar details for drill holes MNB032 to MNB035.

Geochemical Sampling Procedures

Drill core samples were shipped to the Saskatchewan Research Council Geoanalytical Laboratories (SRC) in Saskatoon, Saskatchewan, in secure containment for preparation, processing, and whole rock and multi-element analysis by ICP-MS2 using total 4-acid digestion (HF:NHO3:HCl:HClO4). Assay samples comprise 0.2 to 1.5 m continuous samples of cut-core samples over nickel-sulphide mineralized intervals determined with a handheld XRF. Point samples comprise an isolated 0.1 to 0.5 m sample to characterize the rock types, alteration, structure, and potential for mineralization. The SRC is an ISO/IEC 17025/2005 and Standards Council of Canada certified analytical laboratory. Blanks, standard reference materials, and quartered core repeats were inserted into the sample stream at regular intervals by Metal Energy and the SRC in accordance with Metal Energy's quality assurance and quality control (QA/QC) procedures. Geochemical assay data are subject to verification procedures by qualified persons employed by Metal Energy prior to disclosure.

All reported depths and intervals are drill hole depths and intervals, unless otherwise noted, and do not represent true thicknesses, which have yet to be determined.

For the latest videos from Metal Energy, Ore Group, and all things Mining, subscribe to our YouTube Chanel: youtube.com/@theoregroup

About the Manibridge Project

Manibridge encompasses 4,368 hectares within the world-class Thompson Nickel Belt. The Project is 20 kilometers southwest of Wabowden, which has significant infrastructure and capacity that has supported previous exploration programs and mine development, including year-round highway access via Highway 6.

Table 2 below shows some of the historic drill intersections on the Manibridge project.

Table 2 - Selected Historic and Recent Drill Intersections on Manibridge

|

Hole Number |

Location |

From (m) |

To (m) |

Interval (m) |

%Ni |

%Ni*m |

|

6-60 |

Underground |

33.83 |

75.59 |

41.76 |

1.80 |

75.02 |

|

W50-39 |

Mined |

98.45 |

163.98 |

65.53 |

1.10 |

72.14 |

|

W50-27 |

Mined |

185.93 |

210.01 |

24.08 |

2.93 |

70.61 |

|

W50-34 |

Mined |

86.26 |

110.64 |

24.38 |

1.88 |

45.76 |

|

W50-31 |

Mined |

244.75 |

261.52 |

16.77 |

2.67 |

44.84 |

|

W50-05 |

Mined |

311.51 |

336.80 |

25.29 |

1.57 |

39.64 |

|

MN08-01 |

Surface |

156.50 |

195.75 |

39.25 |

0.98 |

38.47 |

|

W50-28 |

Mined |

203.30 |

211.99 |

8.69 |

4.15 |

36.07 |

|

W50-09 |

Mined |

178.92 |

198.73 |

19.81 |

1.80 |

35.62 |

|

6-42A |

Underground |

270.51 |

287.43 |

16.92 |

1.98 |

33.44 |

|

W50-33 |

Mined |

274.93 |

289.56 |

14.63 |

2.15 |

31.50 |

|

MNB004* |

Surface |

150.45 |

183.4 |

32.95 |

0.88 |

29.00 |

|

W50-50 |

Surface |

184.40 |

196.60 |

12.20 |

1.24 |

15.13 |

Notes to Table 2:

- Cut-off grade = 0.3% Ni

- Maximum consecutive internal dilution = 3.0 m downhole

- Historic drill holes have not been verified or confirmed with twinned drill holes

- Metal Energy considers "high-grade" to be nickel mineralization with a concentration greater than 0.8% Ni.

- All reported depths and intervals are drill hole depths and intervals, unless otherwise noted, and do not represent true thicknesses, which have yet to be determined.

- "*" Drilled by Metal Energy in 2022

Table 3 – Individual interval and total drill hole composite assay results

|

DDH |

From |

To |

Interval |

Ni% |

Cu% |

Co% |

Ni eq.% |

GT (Ni eq%*m) |

|

MNB032 |

190.50 |

191.00 |

0.50 |

0.32 |

0.00 |

0.01 |

0.33 |

0.17 |

|

|

196.50 |

199.00 |

2.50 |

0.32 |

0.00 |

0.01 |

0.33 |

0.83 |

|

|

207.00 |

215.00 |

8.00 |

0.40 |

0.01 |

0.02 |

0.43 |

3.44 |

|

|

308.00 |

311.00 |

3.00 |

0.35 |

0.01 |

0.01 |

0.36 |

1.08 |

|

|

314.00 |

354.00 |

40.00 |

0.64 |

0.01 |

0.01 |

0.66 |

26.40 |

|

includes |

316.50 |

318.00 |

1.50 |

1.18 |

0.06 |

0.02 |

1.23 |

1.85 |

|

and includes |

327.00 |

331.00 |

4.00 |

1.06 |

0.02 |

0.02 |

1.09 |

4.36 |

|

and includes |

347.00 |

348.00 |

1.00 |

1.14 |

0.02 |

0.02 |

1.17 |

1.17 |

|

Composite Summary |

|

54.00 |

0.57 |

0.01 |

0.01 |

0.59 |

31.91 |

|

|

MNB033 |

154.00 |

156.00 |

2.00 |

0.31 |

0.02 |

0.04 |

0.37 |

0.74 |

|

|

176.00 |

176.60 |

0.60 |

0.35 |

0.01 |

0.02 |

0.38 |

0.23 |

|

|

183.20 |

184.30 |

1.10 |

0.47 |

0.00 |

0.01 |

0.48 |

0.53 |

|

|

230.00 |

232.00 |

2.00 |

0.37 |

0.01 |

0.01 |

0.39 |

0.78 |

|

|

239.00 |

241.00 |

2.00 |

0.45 |

0.01 |

0.01 |

0.48 |

0.96 |

|

|

244.00 |

249.00 |

5.00 |

0.36 |

0.01 |

0.01 |

0.38 |

1.90 |

|

|

263.00 |

281.00 |

18.00 |

0.90 |

0.02 |

0.01 |

0.93 |

16.74 |

|

includes |

264.00 |

268.00 |

4.00 |

1.09 |

0.03 |

0.02 |

1.12 |

4.48 |

|

and includes |

271.00 |

276.00 |

5.00 |

1.11 |

0.02 |

0.02 |

1.15 |

5.75 |

|

and includes |

280.00 |

281.00 |

1.00 |

1.13 |

0.02 |

0.02 |

1.16 |

1.16 |

|

|

284.05 |

285.00 |

0.95 |

0.31 |

0.01 |

0.01 |

0.33 |

0.31 |

|

|

289.00 |

290.00 |

1.00 |

0.50 |

0.00 |

0.01 |

0.51 |

0.51 |

|

|

297.00 |

299.50 |

2.50 |

0.36 |

0.00 |

0.01 |

0.38 |

0.95 |

|

|

303.00 |

321.00 |

18.00 |

0.42 |

0.00 |

0.01 |

0.44 |

7.92 |

|

Composite Summary |

|

53.15 |

0.57 |

0.01 |

0.01 |

0.59 |

31.57 |

|

|

MNB034 |

150.72 |

156.67 |

5.95 |

0.43 |

0.01 |

0.01 |

0.46 |

2.74 |

|

|

184.00 |

189.00 |

5.00 |

0.36 |

0.00 |

0.01 |

0.37 |

1.85 |

|

|

200.10 |

201.10 |

1.00 |

0.47 |

0.02 |

0.01 |

0.49 |

0.49 |

|

|

204.85 |

233.00 |

28.15 |

1.06 |

0.02 |

0.02 |

1.10 |

30.97 |

|

includes |

208.30 |

211.00 |

2.70 |

1.61 |

0.03 |

0.02 |

1.65 |

4.45 |

|

and includes |

217.00 |

233.00 |

16.00 |

1.27 |

0.03 |

0.02 |

1.31 |

20.96 |

|

|

238.00 |

239.00 |

1.00 |

0.31 |

0.00 |

0.01 |

0.33 |

0.33 |

|

|

244.00 |

246.00 |

2.00 |

0.44 |

0.01 |

0.01 |

0.45 |

0.90 |

|

|

249.00 |

251.00 |

2.00 |

0.59 |

0.01 |

0.03 |

0.64 |

1.28 |

|

|

260.00 |

262.00 |

2.00 |

0.31 |

0.00 |

0.01 |

0.33 |

0.66 |

|

|

268.00 |

281.00 |

13.00 |

0.68 |

0.02 |

0.01 |

0.70 |

9.10 |

|

includes |

277.00 |

280.00 |

3.00 |

1.31 |

0.03 |

0.02 |

1.35 |

4.05 |

|

|

284.00 |

286.00 |

2.00 |

0.38 |

0.01 |

0.00 |

0.40 |

0.80 |

|

|

290.00 |

291.20 |

1.20 |

0.38 |

0.07 |

0.02 |

0.43 |

0.52 |

|

Composite Summary |

|

63.30 |

0.75 |

0.02 |

0.01 |

0.78 |

49.63 |

|

|

MNB035 |

132.00 |

135.00 |

3.00 |

0.49 |

0.01 |

0.02 |

0.51 |

1.53 |

|

|

148.00 |

150.72 |

2.72 |

0.62 |

0.01 |

0.01 |

0.64 |

1.74 |

|

|

169.00 |

183.00 |

14.00 |

0.38 |

0.01 |

0.01 |

0.40 |

5.60 |

|

|

189.70 |

221.00 |

31.30 |

1.15 |

0.03 |

0.02 |

1.19 |

37.25 |

|

includes |

191.00 |

216.00 |

25.00 |

1.33 |

0.04 |

0.02 |

1.37 |

34.25 |

|

|

230.00 |

249.75 |

19.75 |

0.51 |

0.01 |

0.01 |

0.53 |

10.47 |

|

includes |

248.10 |

248.50 |

0.40 |

1.04 |

0.03 |

0.02 |

1.08 |

0.43 |

|

and includes |

249.25 |

249.50 |

0.25 |

1.38 |

0.02 |

0.02 |

1.42 |

0.36 |

|

|

256.50 |

259.50 |

3.00 |

0.92 |

0.02 |

0.02 |

0.95 |

2.85 |

|

includes |

258.25 |

259.25 |

1.00 |

1.52 |

0.04 |

0.03 |

1.57 |

1.57 |

|

|

264.00 |

264.50 |

0.50 |

0.42 |

0.13 |

0.02 |

0.49 |

0.25 |

|

Composite Summary |

|

74.27 |

0.77 |

0.02 |

0.02 |

0.80 |

59.68 |

|

|

NOTES: |

||||||||

Table 4 – Drill hole collar details

|

DDH |

Target Area |

Section |

East |

North |

Elevation |

Azimuth |

Dip |

EOH |

|

MNB032 |

Manibridge Mine |

6 North |

510,794 |

6,062,195 |

236 |

300 |

-80 |

368 |

|

MNB033 |

Manibridge Mine |

6 North |

510,794 |

6,062,195 |

236 |

300 |

-72 |

341 |

|

MNB034 |

Manibridge Mine |

6 North |

510,794 |

6,062,195 |

236 |

300 |

-62 |

314 |

|

MNB035 |

Manibridge Mine |

6 North |

510,794 |

6,062,195 |

236 |

300 |

-50 |

282 |

|

4 DDH |

|

|

|

1,305 |

||||

|

NOTES: East and North units are metres using NAD83 datum, UTM Zone 14N |

||||||||

About Metal Energy Corp.

Metal Energy is a nickel and battery metal exploration company with two projects, Manibridge and Strange, in the politically stable jurisdictions of Manitoba and Ontario, Canada, respectively. The Manibridge project is 85% owned by Metal Energy and 15% owned by Mistango River Resources Inc. (CSE: MIS). The Strange project is subject to earn-in agreements where the Company can acquire 100% exploration rights to approximately 12,000 hectares.

QP Statement

The technical information contained in this news release has been reviewed and approved by Mike Sweeny, P.Geo., Vice-President, Exploration & Development for Metal Energy, and a Qualified Person as defined in "National Instrument 43-101, Standards of Disclosure for Mineral Projects."

For further information, please contact:

Metal Energy Corp.

MERG on the TSXV

James Sykes, CEO

jsykes@oregroup.ca

306-221-8717

Reader Advisory

Certain information set forth in this news release contains forward-looking statements or information ("forward-looking statements"), including details about the business of the Company. By their nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's control, including the impact of general economic conditions, industry conditions, volatility of commodity prices, currency fluctuations, environmental risks, operational risks, competition from other industry participants, stock market volatility. Although the Company believes that the expectations in its forward-looking statements are reasonable, its forward-looking statements have been based on factors and assumptions concerning future events which may prove to be inaccurate. Those factors and assumptions are based upon currently available information. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on the forward-looking statements, as no assurance can be provided as to future results, levels of activity or achievements. Risks, uncertainties, material assumptions and other factors that could affect actual results are discussed in our public disclosure documents available at www.sedar.com including the Filing Statement dated November 15, 2021. Furthermore, the forward-looking statements contained in this document are made as of the date of this document and, except as required by applicable law, the Company does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release